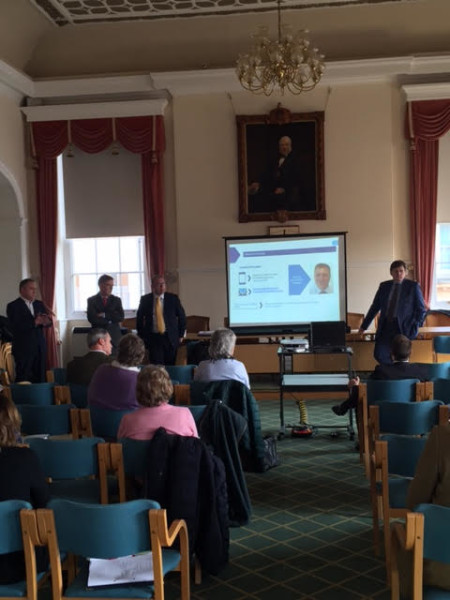

On Friday, I hosted an excellent information session for local businesses on the auto-enrolment pension reforms being introduced by the Government.

We were joined by three very informative speakers: Stephen Rowntree from the Pensions Regulator, Neil Morrow from the EB Partnership, and Duncan Singer from Aviva, all to explain the changes, how businesses can manage the transition, and how the change can be a positive thing for both businesses and employees.

At the moment, most people in Britain aren’t saving enough for retirement. Auto enrolment aims to change that by making workplace pensions compulsory. With these reforms six million savers will be created immediately.

This change forms part of a wider set of reforms designed to ensure that the UK has a pension system fit for the 21st Century and enables individuals to save towards achieving the lifestyle they aspire to in retirement while minimising the burden on employers and taxpayers.

When this is combined with the record levels of employment that the Government’s Long Term Economic Plan has delivered, this means that more people than ever are putting money away for retirement.

Because of this, I back the plans 100% but, as a small business owner myself, am also all too aware of the need to stay a step ahead of regulation and how government rule changes can easy wrong foot even the vigilant. This is why we held this summit and is why I will hold more in the future and as when I can help.

Special thanks go to our three speakers and to David Gleave of Test Valley Borough Council whose help was instrumental in making the event happen.